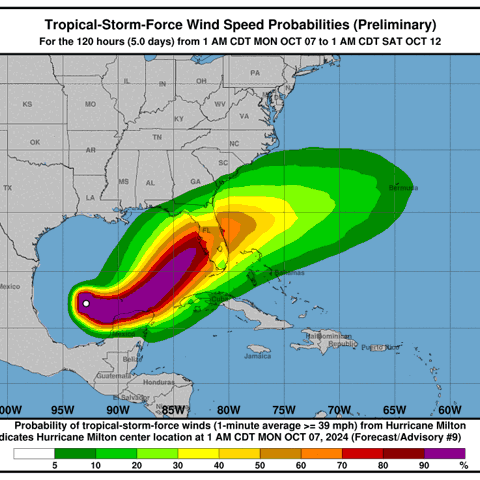

Hurricane Milton has formed in the Gulf of Mexico, and current models suggest it will develop into a strong hurricane before making landfall. Meteorologists expect it will be a "major" hurricane by Wednesday and should impact Florida's west coast.

This region is already dealing with the aftermath of Hurricane Helene.

When natural disasters strike, they often leave behind significant property damage. However, things can become even more complicated when multiple events, such as hurricanes or storms, hit the same area in quick succession.

This creates a complex situation known as concurrent damage, where damage from one storm overlaps with damage from another. In addition to that, mitigation—steps taken to prevent further damage—is needed, and homeowners may find themselves in a tricky position when dealing with their insurance companies.

This article will explore how a public adjuster can assist property owners with concurrent damage, help navigate the challenges of back-to-back storms, and ensure proper mitigation to protect their claims.

What Is Concurrent Damage?

Concurrent damage refers to damage caused by multiple events, such as two storms or a hurricane followed by a tropical storm, that affect the same property quickly. For example, the damage is considered concurrent if a hurricane causes roof damage and a subsequent storm causes flooding.

This can complicate the insurance claims process because it may be difficult to determine which storm caused which portion of the damage and whether all of the damage is covered under a single insurance policy or separate claims must be filed.

Why Concurrent Damage Matters in Insurance Claims

Concurrent damage matters because insurance companies typically want to assess each event separately. This is where things get complicated for property owners. When you file a claim, your insurance company may try to differentiate the damage caused by each event.

If there’s no clear distinction, they might try to deny part of the claim or cover only the damage from one event, leaving you responsible for the rest. The burden of proof often falls on the property owner to demonstrate how much damage occurred from each storm. Without professional guidance, this can become a bureaucratic nightmare.

How Public Adjusters Help with Concurrent Damage Claims

A public adjuster specializes in managing complex claims like those involving concurrent damage. They have the experience and tools to thoroughly inspect and document the damage caused by each event, ensuring that property owners receive fair compensation. Public adjusters help by:

- Distinguishing between events: They can help identify which damages are attributable to which storm, ensuring that the insurance company can’t deny coverage based on a lack of clarity.

- Maximizing coverage: Public adjusters know how to present a claim in a way that leverages your insurance policy to cover all eligible damages, even when they are caused by multiple storms.

Back-to-Back Storms and Their Impact on Property Damage

When multiple storms hit the same area in quick succession, the damage they cause can compound. For instance, a roof weakened by the first storm might be completely torn off by the second. Similarly, floodwaters from the second storm might exacerbate existing water damage.

Back-to-back storms not only increase the extent of property damage but also complicate the claims process. Determining how much of the damage is new versus how much was caused by the earlier storm can become contentious when negotiating with insurance companies.

Implications of Back-to-Back Storms for Insurance Claims

Most homeowners’ insurance policies require you to file a separate claim for each event, especially if a significant amount of time has passed between storms. However, in the case of back-to-back storms, the distinction between what is "new" damage and what is simply worsened damage from the previous event can blur. Insurance companies may try to:

- Limit payouts based on their interpretation of your policy’s coverage limits for each event.

- Delay processing, using the complexity of concurrent damage as an excuse to prolong the claims process.

- Deny portions of the claim, particularly if they argue that proper mitigation wasn’t taken after the first storm.

Understanding Mitigation After the First Event

Mitigation is the process of taking immediate action to prevent further damage after an initial event. For example, after a hurricane damages your roof, you are responsible for protecting your property from further rainwater intrusion, perhaps by installing a temporary tarp or covering exposed areas.

Failing to take reasonable mitigation steps can result in your insurance company denying coverage for additional damage caused by subsequent storms.

The Role of a Public Adjuster in Mitigation Compliance

Public adjusters help homeowners not only document the original damage but also ensure that mitigation efforts are properly executed and documented. This is critical because insurance companies will require proof that you did everything possible to protect your property from further damage. A public adjuster can:

- Guide you through the mitigation process by recommending specific steps to protect your home.

- Document mitigation efforts with photos and reports to ensure compliance is clearly shown in the claim.

The Importance of Timely Damage Assessment

Timely damage assessment is crucial in separating concurrent damage from one event to another. If you wait too long after the first storm to assess damage, subsequent storms might make it impossible to distinguish between what was caused by each event.

A public adjuster can help by quickly assessing and documenting the damage after each storm, ensuring you have clear records to support your claims.

How Public Adjusters Handle Claims Involving Multiple Events

Public adjusters specialize in dealing with claims that involve multiple events. They understand how to allocate damages correctly to each storm, ensuring that the insurance company does not combine or confuse the two events to their advantage. Public adjusters also:

- Organize paperwork and documentation for each event separately, ensuring the claims process is as smooth as possible.

- Work with contractors and experts to estimate repair costs for each event, providing a clear breakdown of the required repairs.

Avoiding Pitfalls in Back-to-Back Storm Claims

One common pitfall after back-to-back storms is failing to differentiate between the damages from each event, leading to claim denial or reduced payouts. Another mistake is not taking adequate mitigation measures after the first storm, which could cause the insurance company to argue that the second storm’s damage was preventable.

A public adjuster ensures that these pitfalls are avoided by handling the process professionally and with attention to detail.

Insurance Policy Implications for Concurrent and Back-to-Back Damage

Insurance policies often contain clauses limiting coverage for multiple claims within a certain period. Additionally, deductibles may apply separately to each event, potentially increasing property owners' out-of-pocket expenses.

This is where a public adjuster's guidance becomes invaluable, as they can interpret policy language, negotiate with insurance companies, and help minimize costs.

Dealing with Insurance Deductibles in Back-to-Back Storms

In many cases, insurance companies will apply separate deductibles for each storm. However, a public adjuster can help negotiate whether a single deductible should apply, especially if the storms are very close in time and the damage is overlapping. This can significantly reduce the financial burden on property owners.

Real-Life Examples: Public Adjusters Assisting After Concurrent Damage

In cases where back-to-back hurricanes have hit coastal areas, public adjusters have been crucial in helping homeowners navigate the complex claims process. For example, after Hurricanes Harvey and Irma, public adjusters successfully helped homeowners file multiple claims while ensuring that they maximized their insurance coverage.

Long-Term Effects of Consecutive Storms on Property and Insurance

Consecutive storms can lead to long-term structural issues that may not be immediately apparent, such as mold growth, foundation damage, or electrical issues. Insurance may not fully cover these ongoing problems if they are not properly documented early on.

Additionally, filing multiple claims in a short period could lead to higher premiums or coverage limitations in the future.

Property owners face unique challenges when dealing with concurrent damage and back-to-back storms. Hiring a public adjuster can significantly simplify the process, ensuring that your claims are handled professionally and that you receive the compensation you deserve.

A public adjuster is your best ally in navigating these complex situations, from distinguishing between different events to ensuring compliance with mitigation requirements.

FAQs

1. What is concurrent damage in the context of a hurricane?

Concurrent damage occurs when multiple events, such as back-to-back storms, cause overlapping damage to a property, complicating the insurance claims process.

2. How does mitigation affect my insurance claim?

Mitigation is required to prevent further damage after an initial event. If you don't take steps to protect your property, your insurance company may deny additional damage claims.

3. Can I file two claims if two storms damage my property?

Yes, but each claim must clearly document the damage caused by each storm. A public adjuster can help you manage these complex claims.

4. What if my insurance company denies part of my concurrent damage claim?

A public adjuster can assist in appealing a denial and ensuring that all damages are properly attributed and covered.

5. How can I reduce my deductible costs if storms hit back-to-back?

If the storms occur within a short time frame, a public adjuster may be able to negotiate with your insurer to apply a single deductible.

SOURCE | National Hurricane Center