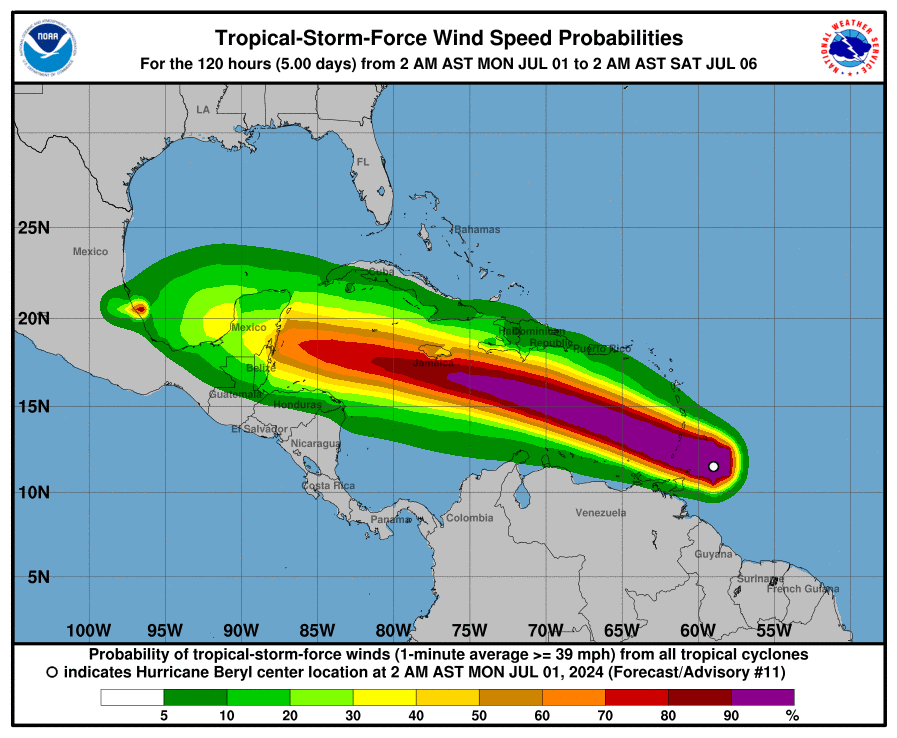

Hurricane Beryl exploded into a category-four storm over the weekend. On Monday morning, it had 130-mile-per-hour wind speeds as it approached the Windward Islands.

Beryl is expected to race across the Caribbean Sea this week before moving towards the coast of Mexico. It's too early to tell if the storm will impact the Gulf states, but weather experts will track every move.

For those who live in an area that may be affected by a hurricane, now is the time to review your disaster preparedness plan. Your priority will be to ensure you have an evacuation plan that protects your family from any potential harm.

Now that hurricane season is in full swing, you should also have a plan for protecting your property. A quick review of your insurance policy can help ensure your property is covered in the event of any damage.

Here are three things you need to look at right away

First, do you have flood components? A basic policy does not always cover a storm surge and rising waters. You may want to consider adding flood coverage to help with your recovery efforts.

Second, wind-driven rain is not the same as other water-damage coverages. Check your policy to see if there is a wind-driven rain exclusion. If there is, you may want to consider changing this component.

Third, let’s talk about your deductible. A higher deductible may cost you less RIGHT NOW, but how does that compare if your business suffers damage? You should compare those costs and determine your risk. A lower deductible may be more cost-effective than lower monthly premiums. (LEARN MORE)

How to Survive a Hurricane Insurance Claim

A hurricane can be devastating for your business because it can bring a storm surge, powerful winds, and torrential rains. However, your business can survive the storm by taking a few steps to prepare.

First, if you know a storm is coming, you can board up your windows to limit the damage. You can also move any valuable equipment, like computers or other devices, to an upper floor if you cannot remove them altogether.

Second, you will want to take photos and videos of your business. This can be used to provide a detailed inventory list of the items inside your company. These contents may be eligible for replacement costs in an insurance claim, so documenting your property before the storm is incredibly helpful. (LEARN MORE)

Challenges you will face with a hurricane damage claim

Filing an insurance claim for your business can quickly become a long and stressful ordeal. If the damage was caused by a hurricane that caused widespread damage, it only worsens.

First, your insurance provider may deal with numerous claims, so their resources may be stretched thin. It could mean you will have adjusters coming in from out of state who may not be familiar with hurricane claims.

In some cases, your insurance company may start rotating adjusters assigned to your claim; this can lead to confusion or prolong the process as each new adjuster has to get up to speed.

Currently, spiking materials costs are also causing issues, as insurance companies may not be accounting for those increases when considering your replacement costs. (LEARN MORE)

You have the right to get help from a Public Adjuster

If a hurricane impacts your business, you may find yourself overwhelmed with phone calls, people knocking on your door, each one saying they can help.

After a storm, knowing who should be involved in an insurance claim is vital.

Our clients turn to Sill because we are North America's most trusted public adjusting firm. If you work with us, we can guide you through each step of a property damage claim. Because we handle hundreds of claims yearly, we know what needs to be done and who should be involved.

You should expect to work with your agent and an adjuster from your insurance company. Most likely, a mitigation company will be there to limit further damage and help clean up the initial damage.

A contractor will be necessary for any rebuilding or restoration efforts.

Most importantly, you will want a public adjuster working for you. Public adjusters are the ONLY ones who can be brought in during an insurance claim and are responsible for protecting your interests.

Sill's disaster response team tracks storm systems and will respond to any affected region immediately after a storm hits. We have the experience to handle any insurance claim but specialize in large residential or commercial property claims.

When you work with Sill, you get the insurance settlement you deserve.

While it's too soon to know if Hurricane Beryl will affect the United States, we will track the storm's location and any additional storms that develop throughout the season.

Our team is available 24/7 by calling 844.650.7455.